Stockton Rush Net Worth in 2026: OceanGate Equity, Career Background, and Legacy Explained

Stockton Rush net worth is a topic people keep revisiting because his name became globally known after the Titan tragedy, and many readers wonder what kind of wealth sat behind OceanGate’s ambitions. The clearest answer is that his fortune was never a simple “TV celebrity number.” It was likely a mix of family background, professional income, and private-company equity—meaning any estimate should be treated as informed but not officially verified.

Quick Facts

- Full Name: Richard Stockton Rush III

- Known As: Stockton Rush

- Born: March 31, 1962

- Died: June 18, 2023

- Age at Death: 61

- Birthplace: San Francisco, California

- Occupation: Businessman, engineer, pilot

- Education: Princeton University (engineering), UC Berkeley (MBA)

- Company: Co-founder and CEO of OceanGate (founded 2009)

- Spouse: Wendy Weil Rush (married 1986)

- Children: Two

- Estimated Net Worth (Estate, 2026): About $20 million

- Estimated Range: Roughly $12 million to $25 million (commonly reported estimates vary)

Stockton Rush Bio

Stockton Rush was an American businessman and engineer best known as the co-founder and CEO of OceanGate, a deep-sea exploration company that pushed into the world of manned submersible tourism. He studied engineering at Princeton and later earned an MBA at UC Berkeley, combining technical confidence with a business-minded approach to building a company around deep-diving vehicles.

Outside of OceanGate, Rush was also known as an aviation and diving enthusiast. In public profiles, he was frequently described as a pilot and lifelong scuba diver, and he openly spoke about his belief that innovation required taking risks. That mindset shaped how OceanGate marketed itself: not as a traditional marine contractor following every established pathway, but as a venture that wanted to “move fast” in a space where moving fast is rarely welcomed.

Wendy Weil Rush Bio

Wendy Weil Rush is best known as Stockton Rush’s wife and as someone who was closely connected to OceanGate’s public-facing work. She attended Princeton University as well, and she has been described as a pilot and educator. Over the years, she was also linked to OceanGate communications and related organizational efforts. In addition to her professional background, Wendy has a widely reported historical connection to the Titanic story: she has been described as a great-great-granddaughter of Isidor and Ida Straus, passengers who died during the Titanic disaster in 1912.

The Rush family largely kept their private life out of the spotlight before 2023. After the Titan tragedy, public attention increased sharply, and Wendy’s connection to both OceanGate and Titanic history became a major point of interest for many readers.

Stockton Rush Net Worth in 2026

Because Stockton Rush died in 2023, any “2026 net worth” discussion is really a discussion of his estate value and whatever assets remained after business realities, legal costs, and other obligations. A practical midpoint estimate often used in public conversations is about $20 million, with a broad range that commonly falls between $12 million and $25 million.

That range exists for a simple reason: OceanGate was a private company, and private-company wealth is hard to pin down from the outside. In public companies, you can see shares, market value, and filings. In private companies, you’re usually working with incomplete information—ownership percentages, funding rounds, debt, and liabilities are not fully transparent to the public.

The Main Sources Behind His Wealth

1) Family background and inherited advantage

Many biographies describe Rush as coming from a prominent, well-connected family, and that matters in any wealth discussion. Family advantage doesn’t automatically mean “massive cash on hand,” but it can mean access: better education opportunities, easier introductions to investors, and a stronger financial safety net when taking big entrepreneurial swings.

Rush’s background is often discussed in terms of legacy and lineage, including well-known historical family connections. In practical terms, even a comfortable financial starting point can change an entrepreneur’s options. It can make it more realistic to fund early prototypes, pay for specialized engineering work, and survive long stretches where a company is building rather than profiting.

2) Career earnings before OceanGate

Before OceanGate became his defining story, Rush worked in technical and business environments that could support strong earnings. He was linked to aerospace-related engineering early in his career and later moved into business roles, including work connected to venture investing and technology leadership. Careers like that can provide high salaries, stock options, and professional networks that later become valuable when raising capital for a startup.

While most people focus on OceanGate as the “money story,” the foundation often starts earlier. A strong early career can build savings, investment habits, and credibility—especially when someone later pitches investors on a high-risk, high-cost concept like manned deep-sea exploration.

3) OceanGate ownership and private-company equity

The biggest “if” in Stockton Rush’s wealth was almost certainly equity in OceanGate. Founders often hold significant ownership, but the value of that ownership depends on what the company is worth, what it owes, and what obligations exist behind the scenes. A private-company stake can look impressive on paper and still be difficult to turn into cash.

OceanGate’s business model was unusual: it blended engineering development with expedition-style revenue. The company became widely known for its Titanic dives, which were reported to cost about $250,000 per person. That number made headlines and created the impression of huge income, but headline pricing is not the same as profit. Deep-sea expeditions are expensive. The support ships, staff, equipment, insurance, research operations, and maintenance costs can be enormous.

Even if OceanGate generated meaningful revenue during active seasons, it likely carried heavy overhead. In businesses with high overhead, the difference between “money coming in” and “money left over” can be dramatic.

4) Speaking, media, and reputation-driven opportunities

Ocean exploration has always had a “storytelling” element, and Rush often positioned himself as someone building the future of underwater access. Public-facing founders can sometimes earn additional income through speaking, consulting, partnerships, or advisory roles. These opportunities usually don’t create the bulk of someone’s net worth, but they can add meaningful income—especially when a founder has a recognizable brand and a specialized message.

In Rush’s case, the brand was built around exploration, innovation, and a willingness to challenge conventional limits. That kind of persona can attract attention and opportunities, even if the core business is still in the “build and prove” stage.

Why OceanGate Revenue Didn’t Automatically Create Massive Personal Wealth

One reason people overestimate founders’ personal wealth is that they confuse company activity with personal bank balance. OceanGate was not a consumer tech giant. It was a specialized engineering venture operating in one of the harshest environments on Earth. The costs of doing business in that world can be relentless.

Here are a few financial realities that likely influenced how much wealth could truly accumulate:

- High R&D costs: Building and improving submersibles, testing hull designs, and maintaining equipment is expensive.

- Operational overhead: Crews, support vessels, logistics, travel, and safety planning add up quickly.

- Limited scale: Even at premium pricing, the number of seats per expedition is small, which caps revenue compared to mass-market businesses.

- Risk and insurance complexity: Operating at extreme depth brings risk issues that can raise costs and limit options.

For these reasons, it’s very possible for a founder to appear “rich” because the company is famous, while the actual personal wealth remains modest compared to Fortune 500 executives or tech founders with billion-dollar exits.

Legal and business fallout after 2023

Because Rush died during a highly public disaster, discussions of estate value can’t ignore the financial aftershocks. After a tragedy of that scale, companies often face investigations, legal claims, insurance disputes, and operational shutdowns. Even when details are private, these factors can affect what an estate is worth, how long it takes to settle, and what assets remain after costs are paid.

Another overlooked factor is private-company equity after a crisis. If a company suspends operations or loses the ability to operate commercially, founder equity can lose a large portion of its practical value. That doesn’t mean it becomes instantly worthless, but it can become far less liquid and far harder to price confidently.

What a reasonable estimate looks like in plain terms

If you want a practical way to think about Stockton Rush’s wealth, picture three buckets: personal assets (cash, property, investments), professional earnings over time, and OceanGate equity that may or may not have held strong value after 2023. Public estimates often settle in the low-to-mid eight figures because those buckets together could plausibly reach that level—especially if family background and long-term investing played a role.

At the same time, it’s wise to treat any exact number as an estimate, not a verified statement. Without public financial filings, the best anyone can do is approximate based on known career facts, private-company founder patterns, and commonly reported ranges.

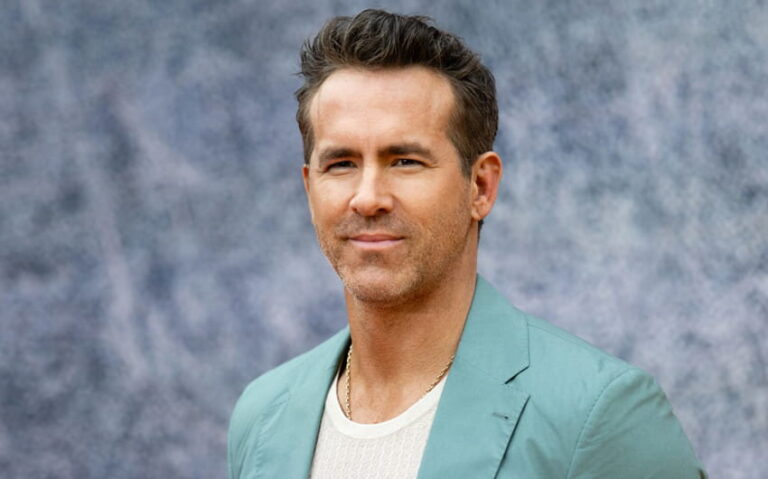

image source: https://www.independent.co.uk/travel/news-and-advice/titanic-visit-stockton-rush-ocean-gate-commercial-submarines-ocean-floor-a7718896.html