Ryan Smith Net Worth in 2026: Qualtrics Billions, Jazz Ownership, and Investments

Ryan Smith net worth keeps trending because he’s not just a tech founder—he’s also a modern sports power player with big, visible moves. The cleanest estimate for 2026 puts him in the mid-billions, with most public tallies clustering around the low-to-mid $2 billion range. What makes his finances interesting is how layered they are: software wealth, private equity-style investments, and franchise ownership that can rise in value even when markets get shaky.

Quick Facts

- Full Name: Ryan Smith (often listed as S. Ryan Smith)

- Estimated Net Worth (2026): About $2.5 billion

- Estimated Range: Roughly $2.1 billion to $3.0 billion

- Birthdate: June 28, 1978

- Age (as of January 2026): 47

- Birthplace: Eugene, Oregon

- Home Base: Utah (commonly linked to Provo/Park City area)

- Known For: Co-founding Qualtrics and building Smith Entertainment Group

- Sports Ownership: Utah Jazz (NBA) and Utah’s NHL franchise under his ownership group

- Spouse: Ashley Smith

- Children: Five

Ryan Smith Bio

Ryan Smith is an American entrepreneur who became a billionaire by building a software company that quietly became essential for businesses. He co-founded Qualtrics while he was still young, then spent years turning it into a major player in experience management—tools that help organizations understand customers and employees at scale. In the last few years, he expanded from tech into sports and live entertainment, creating a public profile that mixes Silicon Valley-style ambition with hometown pride and franchise ownership. That combination is why his name shows up in both business circles and sports headlines.

Ashley Smith Bio

Ashley Smith is Ryan Smith’s wife and a major partner in the public-facing side of his sports and community work. She’s frequently associated with the family’s philanthropy and Utah-based initiatives tied to opportunity, education, and local impact. While Ryan is the visible “deal maker,” Ashley is often described as a steady force behind the family brand—helping shape how their work shows up in the community, not just in business headlines. Together, they’re known for building something that looks like more than a portfolio: a long-term Utah-centered platform blending sports, business, and civic investment.

Ryan Smith’s Net Worth in 2026

A practical 2026 estimate places Ryan Smith at around $2.5 billion, with a reasonable range of $2.1 billion to $3.0 billion. You’ll see slightly lower or higher numbers depending on the source and the moment it was calculated. That swing happens because so much of his wealth is tied to assets whose values move: company shares, private holdings, and sports franchises that are often valued based on market sentiment, revenue expectations, and comparable sales.

Another reason the number shifts is that billionaire math is rarely “cash in the bank.” A huge portion of wealth at this level is ownership—equity that can be extremely valuable on paper, but not instantly liquid without selling something.

Qualtrics: The Foundation That Put Him in the Billionaire Tier

If you want to understand the foundation of his wealth, you start with Qualtrics. The company became a major name in enterprise software by focusing on experience management—collecting and analyzing feedback at scale so organizations can make smarter decisions. It’s not flashy consumer tech, but it’s the kind of product category that can create deep, recurring revenue once big organizations adopt it.

Ryan’s wealth story is closely tied to how Qualtrics evolved through major business chapters: rapid growth, high-profile corporate moves, and the long-term value of owning equity in a company that became widely used across industries. Even when the public can’t see every detail of ownership splits, the overall wealth logic is simple: founders who keep meaningful equity can become billionaires when the company’s valuation climbs and liquidity events occur.

Also, tech wealth doesn’t have to mean constant “new invention” energy. The most durable fortunes often come from software that businesses pay for every year, year after year. That kind of reliability is exactly what turns founder equity into real, compounding wealth.

Smith Entertainment Group and the Power of Owning the Platform

After Qualtrics, the next major pillar is the company that organizes his sports and entertainment footprint: Smith Entertainment Group. This matters because it signals a different kind of wealth strategy. Instead of only holding financial investments, he’s building a platform that can generate revenue from ticketing, sponsorships, events, media rights, and real estate development around venues.

Sports ownership isn’t only about the games. It’s also about controlling an ecosystem: the arena experience, premium seating, partnerships, merch, food and beverage, concerts, and the civic identity that comes with being “the owner.” That ecosystem can create multiple revenue lanes that reinforce each other.

When people search his net worth, they often focus on the purchase price of a team. The more important question is what happens after: how the franchise valuation rises, how the arena footprint grows, and how the ownership group turns a team into a year-round business asset.

Why Sports Franchises Can Grow Faster Than People Expect

Modern professional sports teams have become a category of asset that many billionaires actively chase. The supply is limited—there are only so many teams—and demand is high because ownership offers status, influence, and long-term value potential. Over time, franchise values have often risen even during periods when other markets felt uncertain, largely because media rights, sponsorship demand, and live-event economics can stay strong when a team has a loyal fan base.

For Ryan Smith, owning a major NBA franchise and expanding into NHL territory adds a second major valuation engine to his profile. Even if a team isn’t winning championships every year, the franchise itself can still appreciate because the league grows, the media deals expand, and comparable team sales reset the market upward.

That’s why his net worth discussion tends to move with the broader sports-business conversation. When team values rise league-wide, owners’ balance sheets often rise with them—at least on paper.

Investments, Funds, and the “Owner-Operator” Advantage

Another piece of Ryan Smith’s wealth story is investment activity. Billionaires who come out of enterprise software often develop a strong pattern: they reinvest into startups, funds, and private deals that align with their strengths. Sometimes that’s direct venture investing. Sometimes it’s backing funds with trusted partners. And sometimes it’s buying into businesses connected to their larger platform—sports, entertainment, and community development.

The advantage he has is an “owner-operator” identity. He isn’t only writing checks; he’s building a brand and network that can attract deal flow. When you own a major sports platform, you meet corporate partners, sponsors, and business leaders constantly. Those relationships can create investment opportunities that never show up on public lists.

This is one reason wealthy people often move into sports ownership. It’s not just a purchase—it can become a relationship engine that expands the entire portfolio.

How His Wealth Is Likely Structured

While exact details are private, his wealth is commonly understood as a blend of:

- Equity holdings: Shares tied to business ownership and long-term stakes

- Sports franchise value: Ownership stakes that can appreciate over time

- Private investments: Venture-style and growth-style bets that may not be publicly visible

- Real assets: Potential real estate and venue-related holdings connected to sports and events

- Liquidity planning: Cash reserves and structured assets to support big purchases and operations

This kind of structure is important because it explains why billionaire net worth can look massive while still being “tied up.” A person can be worth billions and still make careful decisions about liquidity, because the best assets are often the least liquid ones.

Philanthropy and Community Visibility

Ryan and Ashley Smith are widely associated with Utah-focused philanthropy and community investment. Philanthropy doesn’t increase net worth, but it does shape how a billionaire’s public profile works. Community initiatives can strengthen relationships, build local goodwill, and reinforce the idea that the ownership group is “all in” on the region.

For sports owners especially, community work becomes part of the brand. Fans don’t just want an owner who writes checks—they want someone who invests in the state, improves the experience, and makes the team feel rooted. That public role can also create business upside through partnerships and long-term civic projects tied to sports and entertainment growth.

What People Commonly Get Wrong About His Net Worth

Two misunderstandings show up a lot when people talk about billionaire owners:

- They assume the purchase price equals personal cash spending: Big acquisitions are often done through ownership groups, structured financing, and long-term planning, not a simple “paid in cash” moment.

- They treat net worth like spendable money: Most of the value is typically equity and long-term assets, not a giant checking account.

In Ryan Smith’s case, it’s more accurate to view his wealth as a living structure—tech equity, sports valuations, private investments, and a growing entertainment platform—rather than a single pile of money.

What His Financial Profile Says About His Long-Term Strategy

When you step back, the pattern is clear: he’s building a Utah-centered empire that blends technology roots with sports and entertainment. That kind of strategy can create long-term resilience because it doesn’t rely on only one revenue stream. Tech can be cyclical. Sports can be cyclical. But together—especially when paired with a strong brand, partnerships, and live-event infrastructure—they can reinforce each other.

That’s the real reason Ryan Smith’s net worth stays in conversation. He’s not just wealthy; he’s actively converting wealth into platforms that can keep growing over time.

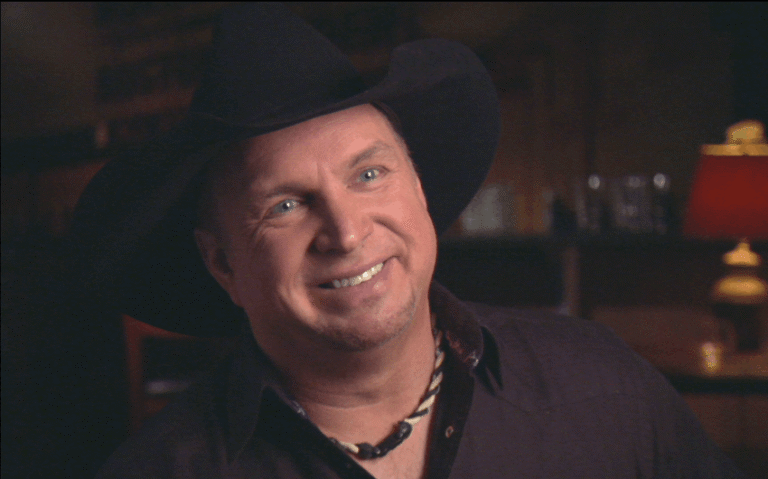

image source: https://www.foxbusiness.com/sports/billionaire-ryan-smith-utah-jazz-nba