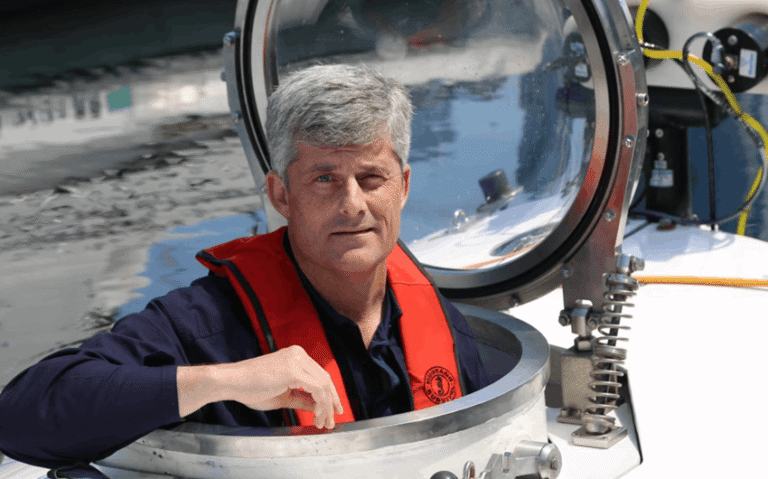

Phil Murphy Net Worth in 2026: Goldman Fortune, Taxes, and Post-Governor Life

Phil Murphy net worth stands out because he’s one of the few modern governors who entered office already wealthy from Wall Street. Most public estimates place him comfortably in the tens of millions, with a commonly cited midpoint near $80 million. What makes his finances worth unpacking is how the money was built long before politics, how investment income can swing from year to year, and how his wealth was managed while he served New Jersey through the end of his second term.

Quick Facts

- Full Name: Philip Dunton Murphy

- Estimated Net Worth (2026): About $80 million

- Estimated Range: Roughly $50 million to $120 million

- Birthdate: August 16, 1957

- Age (as of January 2026): 68

- Most Known For: Former Governor of New Jersey; former U.S. Ambassador to Germany

- Career Background: Longtime Goldman Sachs executive

- Spouse: Tammy Snyder Murphy

- Children: Four

- Left Office: January 20, 2026 (end of second term)

Phil Murphy Bio

Phil Murphy is a financier-turned-politician who built his fortune in the private sector before stepping into public service. He spent decades at Goldman Sachs and rose into senior leadership, including international assignments that helped shape his reputation as a polished, global finance operator. After leaving the firm, he moved into political leadership and public service, serving as U.S. ambassador to Germany and later winning two terms as New Jersey’s governor. His public profile has always carried that unusual combination: progressive policy goals paired with a very Wall Street financial background.

Tammy Murphy Bio

Tammy Snyder Murphy is Phil Murphy’s wife and a visible public figure in New Jersey civic life. During his time as governor, she was closely associated with community initiatives and advocacy efforts, often focusing on issues tied to families and public well-being. While she is frequently discussed in political coverage, she has also maintained a clear identity separate from her husband’s finance résumé, which is why their household is often viewed as a blend of public service, philanthropy, and high-level private-sector wealth.

Phil Murphy Net Worth in 2026

A practical estimate for Phil Murphy’s net worth in 2026 is around $80 million, with a reasonable range of $50 million to $120 million. The wide range is normal for someone whose wealth is largely tied to investments rather than a single public company stake with an easy daily price. At this level, the “number” is usually a snapshot built from portfolio value, property, and other assets, minus liabilities and long-term obligations.

It also helps to separate net worth from salary. A governor’s pay is meaningful, but it’s not what creates a fortune at this scale. For Murphy, the foundation is private-sector earnings and decades of investing. Public service sits on top of that base rather than replacing it.

How Goldman Sachs Built the Foundation

The clearest starting point for Murphy’s wealth is his long tenure at Goldman Sachs. People often focus on “salary,” but the bigger wealth-driver in top finance roles is usually total compensation over time: bonuses, deferred compensation structures, and opportunities that come from senior-level positioning. When you spend decades in high finance and retire at a senior level, the result is often a portfolio large enough that investment growth becomes more important than any single paycheck.

Murphy’s career also included international leadership roles, which tend to come with strong compensation and valuable professional networks. Those networks can matter financially even years later, because they influence how money is managed, where it’s invested, and what opportunities are available after a person leaves the firm.

Investment Income and Why It Can Look “Huge” Some Years

When wealthy households file financial disclosures, the numbers can surprise people. One year might show moderate income, and the next year might show millions. That doesn’t always mean someone suddenly got “richer overnight.” It often means investments were sold, profits were realized, or capital gains were taken in that specific year.

That’s why Murphy’s financial story is better understood as a portfolio-driven life. Portfolio income can be lumpy. It can spike when markets perform well or when assets are sold at the right time. It can also drop when markets cool. Over long stretches, though, a large, well-managed portfolio tends to keep a household in a high-net-worth tier even when yearly income bounces around.

Managing Wealth During the Governor Years

When a wealthy person becomes governor, the conversation quickly shifts from “how much do they have?” to “how is it handled while they’re making decisions?” During his administration, Murphy’s wealth management was structured to create separation between day-to-day governing and personal investments. This is a common approach for high-net-worth public officials who want to reduce conflict concerns and keep the focus on policy rather than personal holdings.

Even with distance structures in place, the underlying financial reality stays the same: the portfolio exists, and it continues to move with markets. The structure is about management and independence, not about erasing wealth.

Real Estate and Other Assets That Often Matter

For people in Murphy’s tier, net worth usually isn’t just “stocks.” It’s a blend of assets that serve different purposes. A typical high-net-worth profile often includes:

- Large investment accounts spread across funds and diversified holdings

- Real estate that functions as both lifestyle and long-term value storage

- Cash reserves for flexibility and stability

- Retirement and deferred compensation tied to earlier career years

Real estate tends to get the most attention because it’s easier for the public to visualize than portfolio allocations. But the portfolio is usually the larger story, especially for someone whose fortune was built in finance.

What Changed After He Left Office in 2026

Murphy left office on January 20, 2026, ending an eight-year run as governor. Financially, leaving office doesn’t change the foundation of his net worth, but it does change the rhythm of life and the types of opportunities that can follow. Former governors with major private-sector backgrounds often have options like speaking engagements, advisory roles, nonprofit leadership, and policy-related work that can add new income streams.

Not everyone chooses those lanes, and it’s not necessary for a person with a large portfolio to chase new paychecks. But as a general pattern, the post-office chapter can create both influence and income opportunities, especially for someone who already has a national network and credibility in both finance and politics.

A Clear, Practical Snapshot

If you want a simple takeaway, this is the most realistic way to view Phil Murphy’s finances in 2026: he is a wealthy former governor whose fortune was built primarily through Goldman Sachs and long-term investing, not through public-sector salary. A grounded estimate sits around $80 million, with a wider range because private portfolios and asset structures aren’t fully visible to the public.

image source: https://www.nbcnews.com/politics/congress/new-jersey-governor-appoints-former-aide-fill-sen-bob-menendezs-seat-rcna166679