Grant Cardone Net Worth in 2026: Real Estate, Businesses, Books, and Income Streams

Grant Cardone net worth is a popular search because he’s loud, visible, and constantly talking about money, real estate, and building wealth fast. The short answer is that he’s very wealthy, mainly from real estate investments, business education products, and sales training companies. What makes his financial story interesting is that his brand is built around teaching success, while his biggest long-term engine appears to be owning assets that can grow and pay him over time.

Quick Facts

- Full Name: Grant Cardone

- Born: March 21, 1958

- Age in 2026: 67 (turns 68 in March 2026)

- Hometown: Lake Charles, Louisiana

- Occupation: Entrepreneur, real estate investor, author, speaker

- Known For: Sales training, Cardone Capital, 10X brand

- Estimated Net Worth: About $600 million

- Spouse: Elena Cardone

- Children: Two daughters

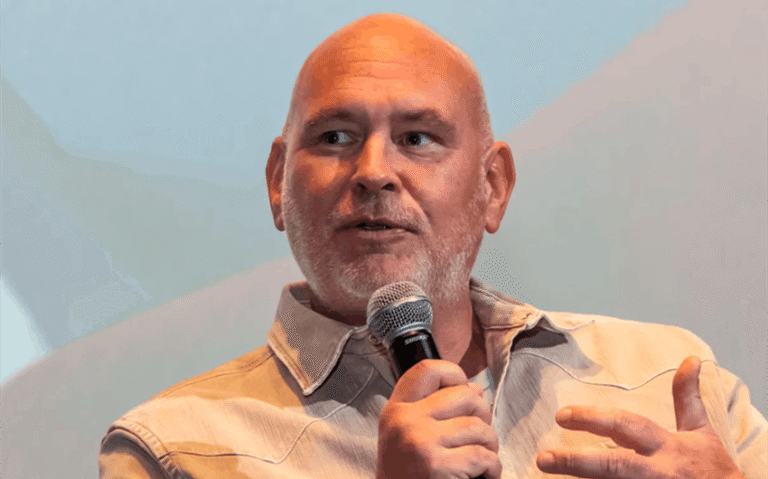

Grant Cardone (short bio): Grant Cardone is an American entrepreneur best known for his sales training content, high-energy business coaching, and large multifamily real estate holdings. Over the years, he built a media-driven brand around motivation and “10X” thinking, while expanding his real estate operation and a network of companies tied to education, events, and consulting.

Elena Cardone (short bio): Elena Cardone is an entrepreneur, author, and speaker who has helped grow the Cardone brand through media, events, and lifestyle-focused content. She frequently appears alongside Grant in interviews and business promotions, and she is widely viewed as a key partner in building the visibility and reach of their overall platform.

So, What Is Grant Cardone Net Worth in 2026?

Grant Cardone net worth in 2026 is estimated at about $600 million. You’ll see different numbers online, sometimes much lower and sometimes much higher, because a big portion of his wealth is tied to real estate and business valuation. Those numbers can swing depending on market conditions, property valuations, debt structures, and how people estimate private-company value.

The most practical way to understand his wealth is this: Cardone appears to have built a high-earning brand business, but his biggest financial muscle is likely the real estate assets underneath it.

The Core Engine: Multifamily Real Estate

When you look at wealthy entrepreneurs, you’ll often notice a pattern. They may become famous through one thing, but their biggest money usually comes from owning assets. In Grant Cardone’s case, the asset story is multifamily real estate—apartment buildings and large residential properties that produce rent income.

Real estate can build massive net worth in three main ways:

- Cash flow: monthly income after expenses

- Appreciation: properties increasing in value over time

- Equity growth: paying down debt while the asset value rises

If someone owns (or controls) a large portfolio, the value can climb quickly in strong markets. Even in slower markets, real estate can still provide steady income. That combination of income and long-term growth is why real estate is often the foundation of large fortunes.

Cardone’s real estate messaging also fits a classic investor mindset: buy assets that pay you, hold them long-term, and scale into larger deals. Whether someone agrees with all his advice or not, the strategy itself is a common blueprint for building wealth at scale.

How Cardone Capital Likely Fits Into His Wealth

A major part of Grant Cardone’s public identity is tied to Cardone Capital and the broader idea of pooling money to buy large properties. In simple terms, these models usually involve raising capital, buying assets, charging fees for managing them, and potentially sharing profits based on performance.

This matters for net worth because it can create multiple layers of income:

- Management fees for running properties and investor relations

- Acquisition fees tied to closing new deals

- Ownership stakes in properties and related entities

- Profit participation if properties perform well

If you combine those layers with a large portfolio, the total wealth picture can grow quickly. That said, real estate is also debt-heavy by nature, and valuations can move up and down. That’s one reason net worth estimates vary widely: two people can look at the same portfolio and produce very different numbers depending on what assumptions they use.

Sales Training and Business Education: The Public-Facing Money Machine

Before most people thought of Grant Cardone as a real estate guy, many knew him as a sales trainer. Sales training can be a very profitable business because it is scalable. Once content is created—courses, books, training programs, and frameworks—it can be sold repeatedly without the same production cost each time.

Cardone has built a recognizable system and brand language around sales and hustle, which turns into products people buy. These products can include:

- Online courses and subscription training libraries

- Corporate training programs

- Coaching packages and consulting

- Books and audiobooks

- Special events and conferences

The benefit of education products is that they can keep selling regardless of market conditions. Even when real estate is slow, people still want income, career growth, and motivation. Cardone’s brand leans heavily into that desire, which is why his education business likely remains a powerful income stream.

Books: Smaller Per Sale, Massive Over Time

Books usually don’t make someone rich on their own unless they sell at an extraordinary level. But they can become a powerful tool for two reasons. First, they generate revenue through sales. Second, they act as marketing that leads to bigger money opportunities like speaking, coaching, and subscriptions.

Grant Cardone’s books function like an entry point. Someone buys a book, likes the message, then moves up the ladder into courses or events. That “ladder” model is common in business education. The book is the low-cost door. The higher-ticket products are where the real profit can be.

Over time, a library of books can also create steady income. Audiobooks, international editions, and ongoing promotions can keep titles selling for years, especially when the author stays visible in the public eye.

Speaking Engagements and Events: Big Revenue, Big Costs

One of the most visible parts of Cardone’s brand is events. Large business events can generate serious revenue through ticket sales, VIP packages, sponsorships, and vendor partnerships. When a personality becomes the main attraction, people will pay not just to learn, but to experience the energy and community.

However, events can also be expensive. Venues, production, staff, marketing, security, and logistics can eat up a big chunk of revenue. Still, if an event is run efficiently and sells out, it can be very profitable. It also strengthens the brand by turning followers into loyal fans who feel personally connected to the movement.

That loyalty can increase lifetime value, meaning supporters keep buying products, showing up to events, and staying subscribed to services year after year.

Social Media and Personal Branding as a Revenue Accelerator

Grant Cardone is a strong example of how a personal brand can function like a business asset. His social media presence drives attention, and attention drives sales. Even when someone criticizes his style, they’re still participating in the visibility that keeps his brand circulating.

Personal branding also boosts negotiating power. A person with a massive audience can command better deals, attract higher-quality business partnerships, and raise money more easily for projects. In the business world, audience is leverage. Cardone has built leverage through constant content and high volume messaging.

How His Lifestyle Ties Into the Brand

Cardone’s lifestyle is part of the pitch. Private jets, luxury travel, expensive watches, big properties—those visuals aren’t just personal choices. They’re marketing. They communicate a message: “This system works.” For followers, that can be motivating. For critics, it can feel like showmanship. Either way, it keeps attention locked.

From a business standpoint, lifestyle content can increase conversion rates. People don’t only buy information; they buy belief. Seeing someone live a certain way can make the belief feel more real, which can increase sales of courses and event tickets.

Of course, high lifestyle also means high expenses. But at Cardone’s scale, those costs may be both personal spending and business spending, depending on how companies are structured and how assets are used for content and marketing.

Why Net Worth Estimates for Grant Cardone Vary So Much

Grant Cardone’s wealth is a perfect example of why net worth numbers can be hard to pin down. A large part of the story is tied to real estate, and real estate involves:

- Market-based valuation: prices shift with interest rates and demand

- Debt: leverage can multiply gains but complicates true equity value

- Private structures: holdings can be spread across multiple entities

- Business valuation: a brand company’s value depends on revenue and assumptions

That’s why one estimate might look conservative and another might look huge. If you value his portfolio aggressively, the number rises. If you value it conservatively and account for debt heavily, the number drops. A mid-to-high hundreds of millions estimate fits the general scale of his claims and public footprint without assuming billionaire-level certainty.

What Could Push His Net Worth Higher

At his level, the biggest net worth leaps typically come from portfolio growth and market timing. If his real estate holdings expand while property values rise, his equity can jump. If his business education side continues scaling through subscriptions and enterprise deals, the brand company becomes more valuable too.

His wealth can also grow through partnerships and acquisitions. A strong personal brand can open doors to deals that most business owners never see, including joint ventures, private placements, and investment opportunities where attention itself becomes part of the value.

Final Thoughts

Grant Cardone net worth in 2026 is best estimated at around $600 million, built from a mix of multifamily real estate, business education, and a high-powered personal brand that drives constant revenue. Whether people love his style or roll their eyes at it, the financial strategy behind the loud marketing is pretty clear: build attention, sell scalable products, and buy assets that can grow over time.

image source: https://www.kind-vibe.com/speakers/grant-cardone